-

1.

Tips for great network listening.

- 2. 1) Identify who will be the people within your company who will need social listening.

- 3. 2) Understand what the figures involved in listening to the network want to know.

- 4. 3) Think about how to turn the data collected into value for each person.

- 5. 4) Determine when each person needs to receive the results of network listening.

- 6. Final conclusions.

Tips for great network listening.

Want to start listening to what’s happening online in your industry? Do you have an eagerness to find out what people think about your products, discover the weaknesses of your competitors and the preferences of your target customers?

Market research based on social listening can rush to your aid, but wait a minute.

Before you buy licenses of the best software and launch into indiscriminate listening, you need to know the so-called s ocial listening best practices.

These best practices are based on 4 simple points that you should consider as the Bible of network listening:

- Who

- What

- As

- When

Keep them in mind, because they will serve as the backbone for your social listening activities.

If you don’t clarify these points before you begin and create a nice table, in which each “who” has its “what,” “how,” and “when,” cosmic mess is assured!

But don’t worry, it’s nothing difficult, on the contrary! Following this process makes your life enormously easier, because then you can ask yourself one question at a time and proceed step by step.

Now let’s look at the four points, with quite a few examples to clarify your ideas!

Before you even begin with listening to the network, you need to be clear about WHO the people who will need to listen to the network will be, obviously making them all active participants in the process!

Network listening serves the following business figures:

- Marketing manager

- Social media manager

- Customer Service

- Corporate management

- Sales department

- Product development and innovation department

- Business analyst

It is not mandatory to involve all of these figures-it all depends on your company’s organization and what you consider priopritical.

Regardless, the network listening project will be set up differently depending on who you intend to involve. Likewise, the information you will derive for each figure will also be different, as we will see in the next section.

Read also: Social media listening and monitoring: 7 practical applications in the enterprise

2) Understand what the figures involved in listening to the network want to know.

The second social listening best practice is defining WHAT business figures want to know.

Remember to also indicate variations of product names, for example, if you know that people call them a certain way, and to indicate whether these products have associated hashtags, social profiles with particular names, and so on.

The work does not end there, however, because you may want to go deeper.

In addition to knowing “how much” each product is talked about, I imagine you will also want to know what topics are most talked about in relation to those products.

For example, those who talk about use cases, problems they have encountered, etc. So you can jot down as many possible themes as you can think of, such as in this case price, quality, ingredients, breakfast, snack, and so on.

Clear? Great, now all you have to do is apply it to your business!

My advice is to do this work in theme with the people who will actually need this information, so that you pull out just what they will need.

3) Think about how to turn the data collected into value for each person.

The question you need to ask yourself is, “What kind of results do the different actors want to see?“

Will summary metrics, such as trend charts over time, suffice, or do they want to be able to read all the individual conversations, because they have to respond to individual users?

Depending on the tool you choose to listen to the network, you will have different graphs showing the results. However, some metrics are common to all instruments:

- Individual mentions of a certain theme (i.e., brand/product/topic/concurrent/trend);

- The total number of mentions on a theme;

- The trend over time of mentions on a theme, comparing multiple themes to see differences;

- The “reach,” or the number of potential people who saw her mentions;

- The “engagement rate,” or how engaging the mentions were for users

- The “share of voice,” that is, the pie chart of the different themes, of the different online channels;

- The content of mentions, such as keywords, hashtags, shared links and so on;

- The geographic distribution of mentions and demographic information about the users who made the mentions

- Sentiment, or the ratio of positive to negative mentions

- Online channels and key influencers who have covered a topic.

By putting together all these possible metrics and all the themes you want to track, potentially endless charts and reports can come out!

Each person should get the right level of information for what he or she needs, and possibly should receive the same kind of information periodically over time so that he or she can see if there are changes, improvements, or not.

Read also: The 9 points to consider when choosing the right Web Listening Tools

4) Determine when each person needs to receive the results of network listening.

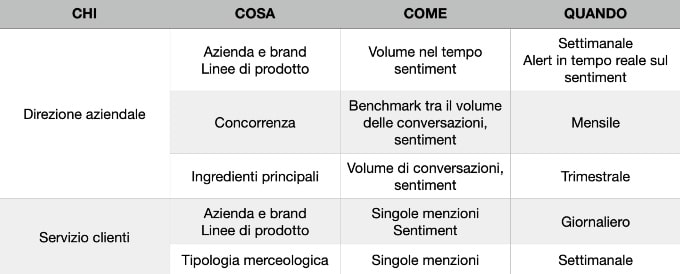

Someone needs to have access to the data on a daily basis, as in the case of the marketing manager and customer service, while management may be satisfied with weekly or monthly reports, some shorter and some more in-depth at more regular time intervals.

Then there are some more sensitive issues for which you need to set up real-time alerts, which need to be received by the right people, not people who read the notification and delete it because they have other things to do!

In short, the point is to create routines and methods so that all the project setup work we did in the first three points is actually USEFUL and the information comes at the right time.

Final conclusions.

At the end of this process, you should have such a table:

The WHO – WHAT – HOW – WHEN process may seem trivial, but I assure you it is far from obvious.

Most companies and marketing agencies that start using network listening do not think about it at all and just set up market research without having any method.

Thus the information gathered is often lacking, incomplete or even forgotten to itself.

He thinks that I worked with a large marketing agency, one of the leading ones in Italy, which despite having purchased a network listening tool that was also very expensive, almost NEVER used it.

The reason was that the various people who would need it had done no work to figure out exactly WHAT they needed, nor had they set up any routines for going to use it periodically, defining a clear WHEN.

So they would end up totally forgetting about it!

That’s why I really insist that if you want to start seriously listening to the network, even when providing reports and data to an agency outside your company, this first step is critical.

Want more information about listening to the network or book a customized consultation for your company?

Contact us now-we at Central Marketing Intelligence are ready to rush to your aid.